Freight Forwarding: a sector that appears resilient in the face of economic, health, and security crises

Freight Forwarding: a sector that appears resilient in the face of economic, health, and security crises

In an increasingly interconnected world, Freight Forwarding (FF) stands as the invisible backbone keeping the wheels of global trade turning even in times of crisis. Yet the sector faces mounting challenges, intensified by recurring economic, health, and geopolitical disruptions.

In an increasingly interconnected world, Freight Forwarding (FF) stands as the invisible backbone keeping the wheels of global trade turning even in times of crisis. Yet the sector faces mounting challenges, intensified by recurring economic, health, and geopolitical disruptions.

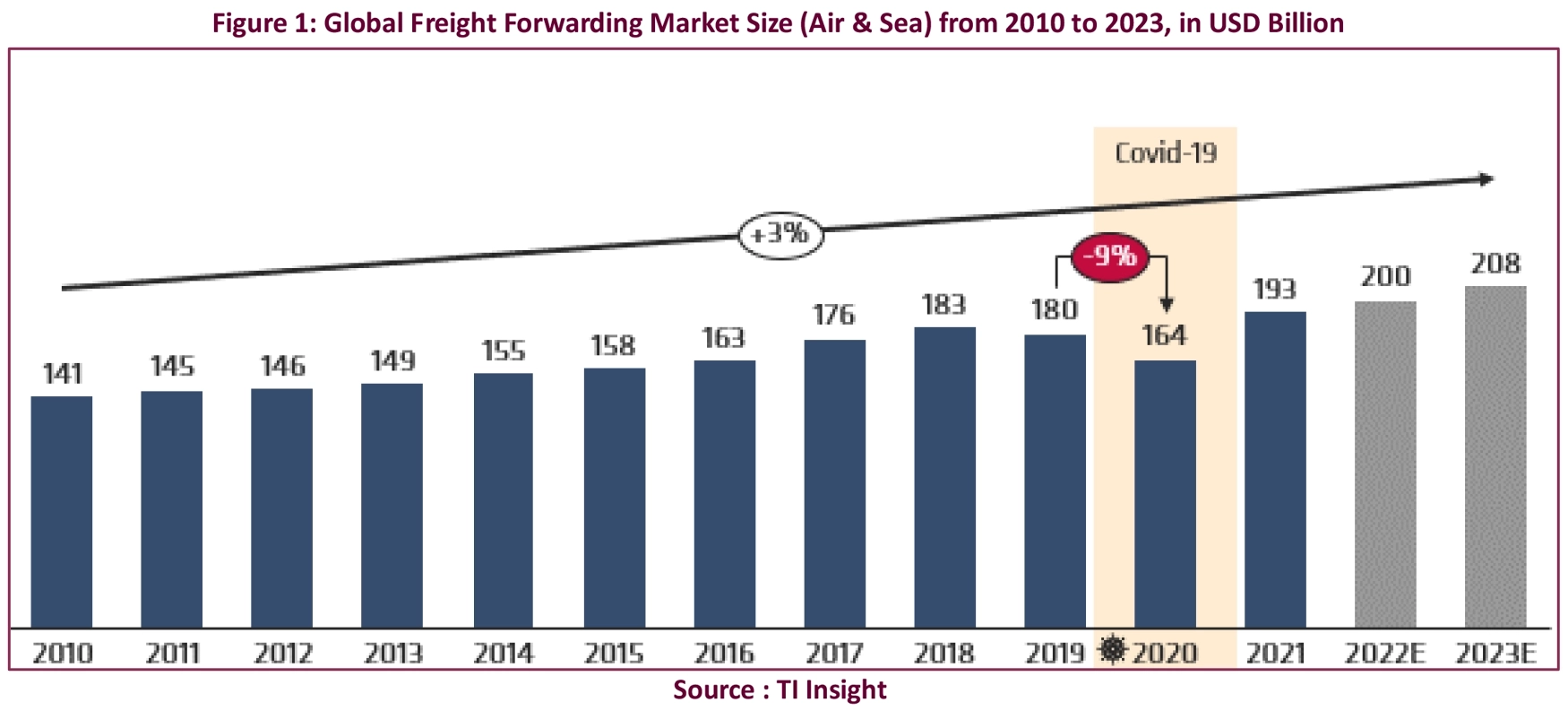

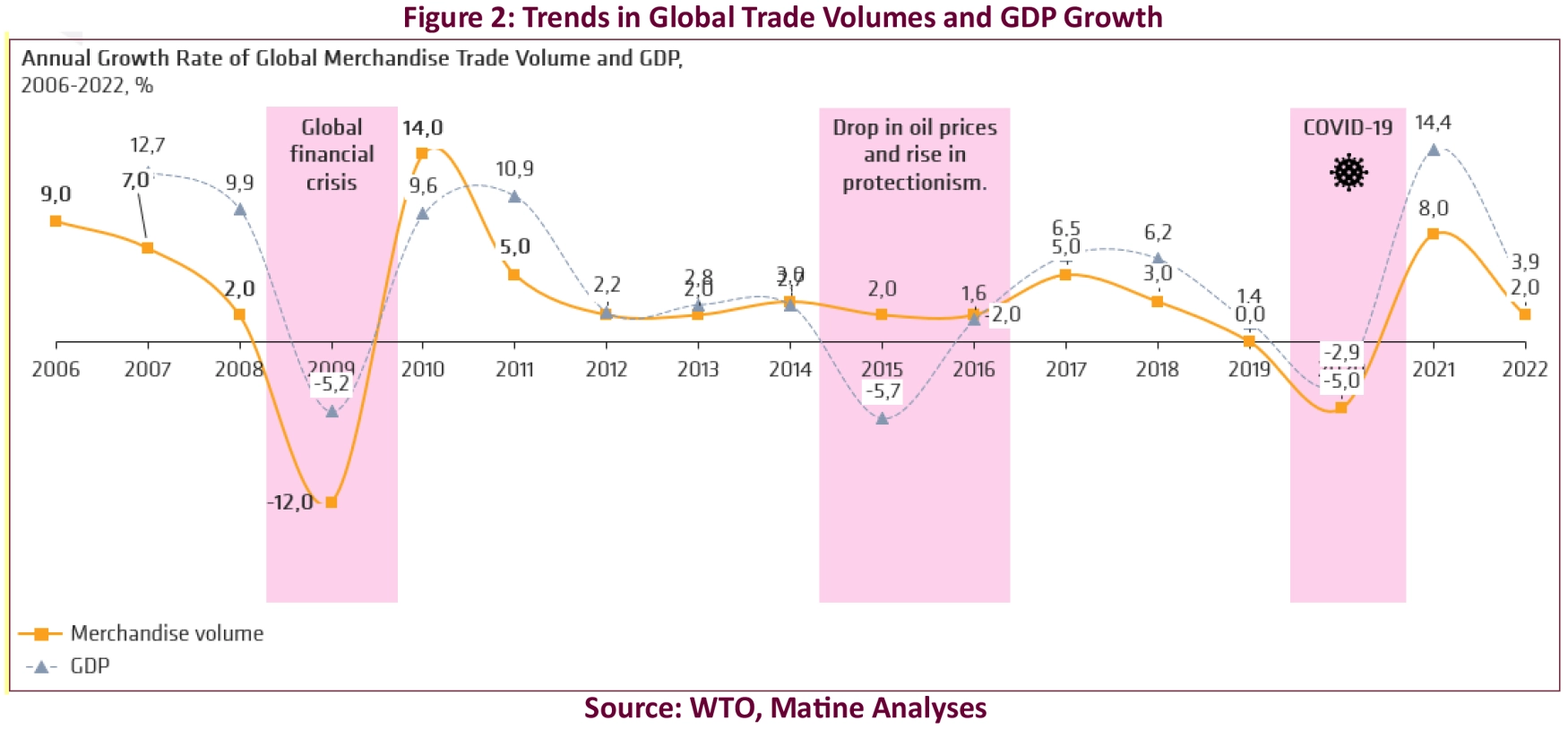

In 2023, the global FF market (Air & Sea) was valued at $208 billion, reflecting a moderate growth of 3% since 2010. However, beneath this veneer of stability lies a market marked by deep fluctuations. Global crises—such as the 2008 financial crash, the COVID-19 pandemic, and more recently, geopolitical tensions (notably in the Red Sea) have triggered rate volatility and disrupted supply chains. Nevertheless, this volatility also reveals growth opportunities for players agile enough to adapt to evolving economic landscapes.

To cope with global crises and rising transportation costs, industrial players often adjust their production levels, leading to a decline in freight volumes handled by freight forwarders. This volume volatility compels FF operators to adapt their strategies accordingly, often by increasing prices to offset lower volumes or rerouted shipments, which helps explain the sector’s apparent stability.

Outside crisis periods, when merchandise demand tends to drop, it generally remains relatively stable or sees moderate growth rates. Similarly, demand for freight forwarding services remains steady. The market experiences little change in terms of volume and is primarily driven by pricing. Prices themselves are influenced by several factors, including freight costs, market competition (in terms of both pricing and service quality), currency exchange rate fluctuations, oil prices, etc.

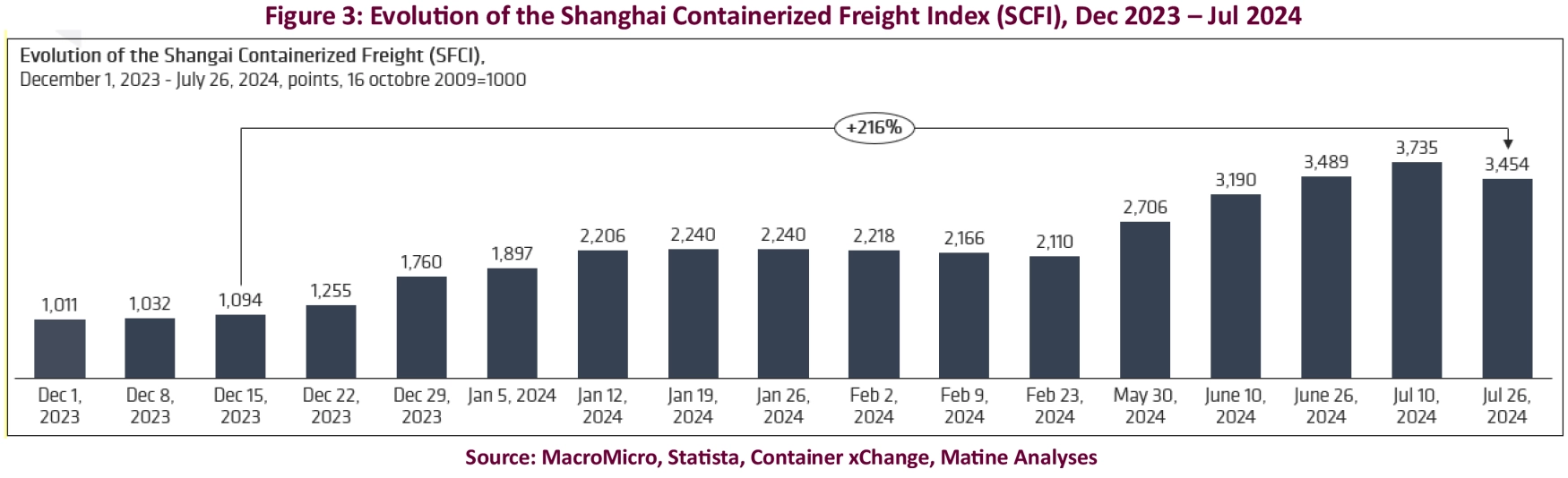

A recent example of crisis is the security situation in the Red Sea, a strategic region for maritime transport, crossed by the Suez Canal, through which approximately 10% of global container traffic passes. At the end of 2023 and the beginning of 2024, an escalation of security threats in this area targeted vessels navigating the Gulf of Aden, the Red Sea, and the Suez Canal. This instability caused a significant increase in maritime transport costs, notably through higher freight rates and insurance premiums, as well as the rerouting of numerous shipments via the longer route around the Cape of Good Hope. The Shanghai

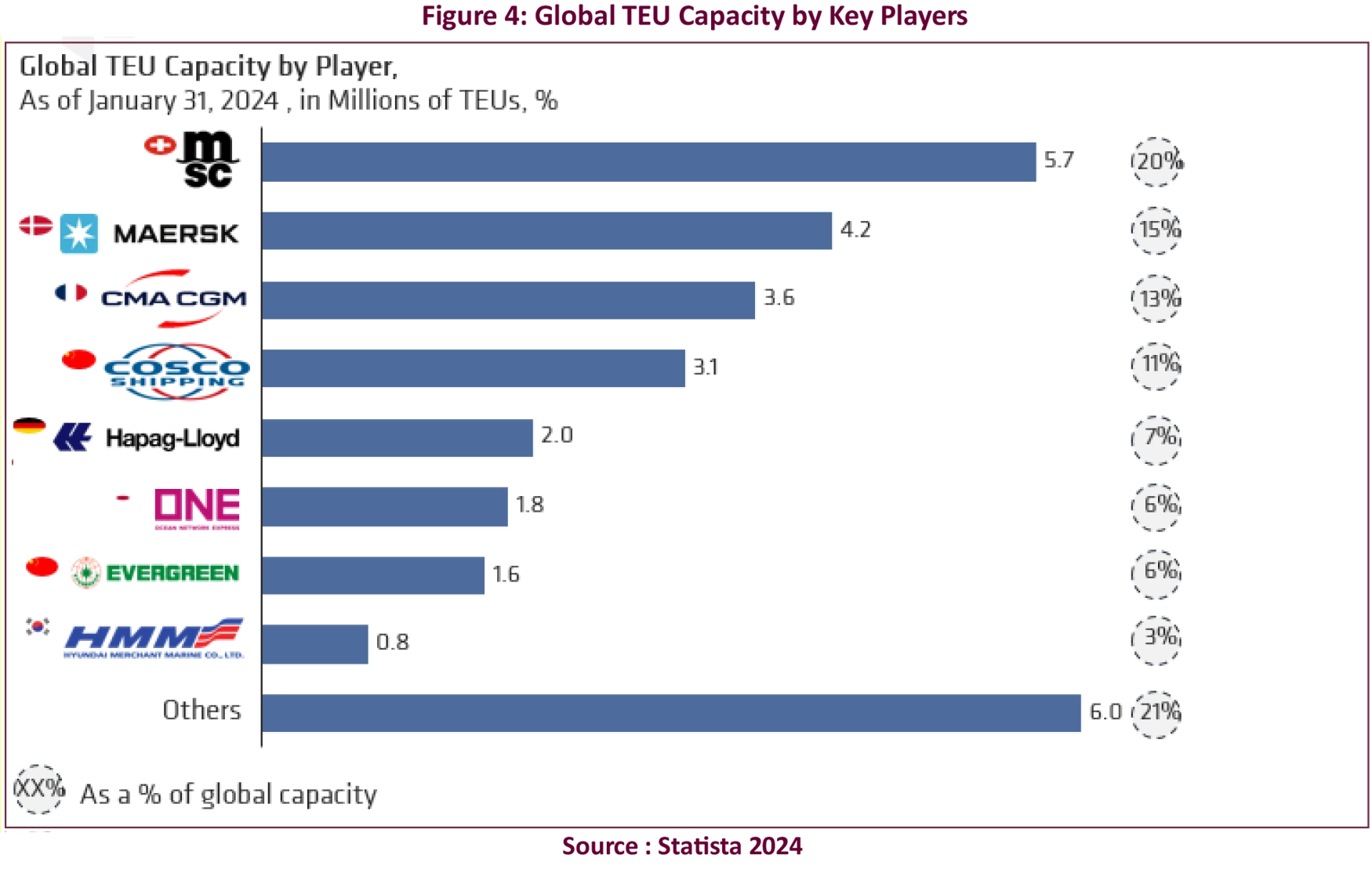

Furthermore, the increase in maritime transport prices is largely due to the bargaining power of shipping companies. Indeed, approximately 80% of global capacity is controlled by only eight major carriers, thus limiting freight forwarders’ room for negotiation on rates. The concentration of flows on certain strategic routes intensifies competition among industry players, who compete to secure transport capacity, which in turn strengthens the negotiating power of shipping companies. During crises, such as the one affecting the Red Sea, these carriers can more easily impose price increases.

Faced with the increasing complexity of their activities and the challenges of a saturated market, FF players have adopted various strategies to mitigate risks while maximizing value creation

• Mergers & Acquisitions: An Unstoppable Growth Lever

In recent years, the sector has been marked by a wave of mergers and acquisitions, which have become a central lever for consolidation and upgrading among players. In 2022, transaction volumes reached nearly $120 billion, with an average deal size of $400 million, 44% of which were completed by strategic investors between 2019 and 2023.

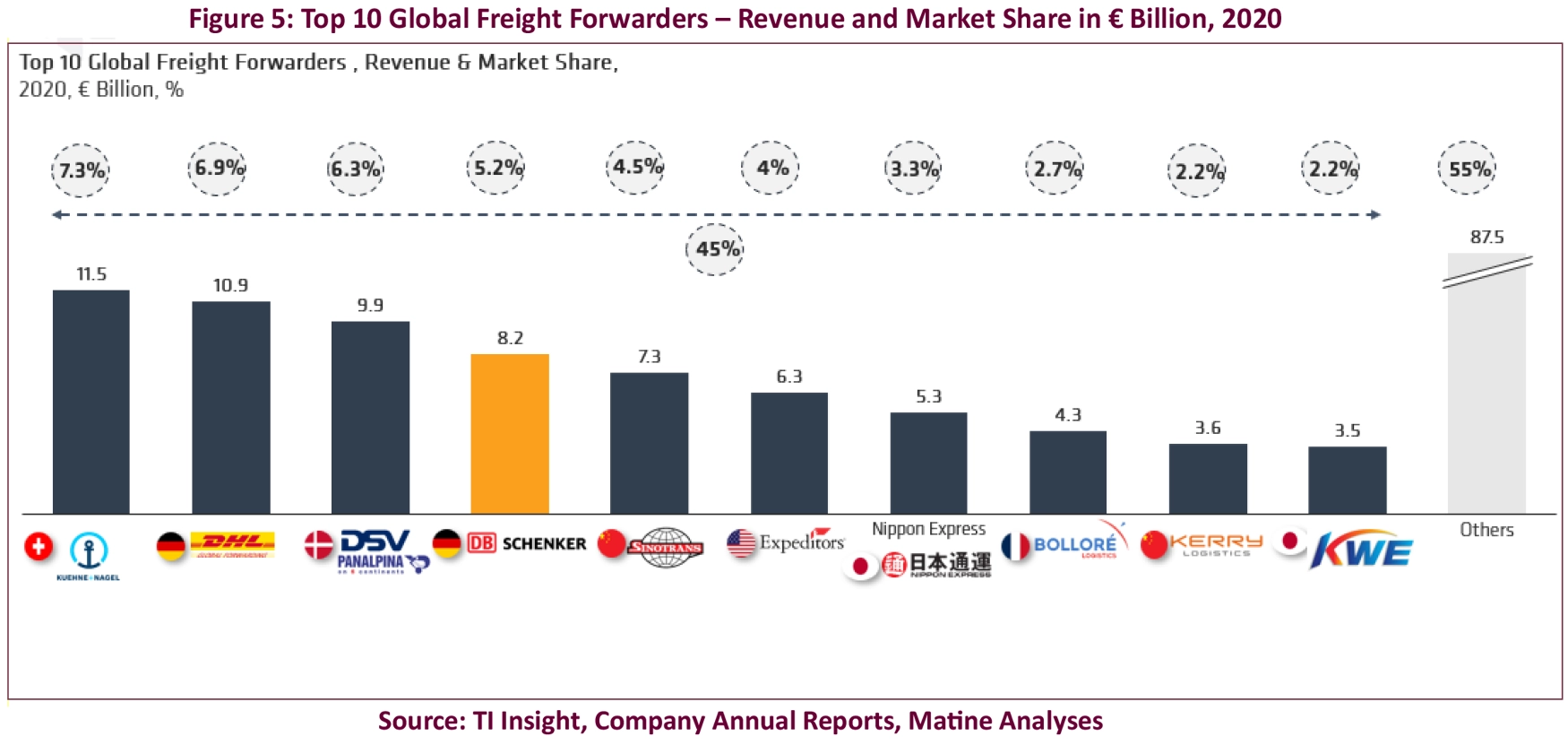

Notable examples include DSV, which acquired Panalpina in 2019 for $4.6 billion, followed by Agility’s Global Integrated Logistics in 2021 for $4.1 billion, and more recently DB Schenker in 2024 for $14.3 billion, thereby strengthening its position among the sector’s global leaders. Other major players such as DHL, Kuehne + Nagel, and Bolloré also pursue active acquisition strategies. This dynamic contributes to significant market concentration, with the top ten operators alone accounting for 45% of the global market share.

Moreover, shipping lines are pursuing vertical integration strategies, aiming to control the entire logistics chain. CMA CGM, for instance, acquired CEVA Logistics in 2019 for $1.65 billion, thereby strengthening its offering of integrated transport solutions.

• Joining international networks: a key to global coverage

To access new markets and expand their global footprint, many freight forwarders choose to join international networks such as WCA (World Cargo Alliance) or WIFFA (World International Freight Forwarder Alliance). These platforms enable global collaboration, allowing members to deliver end-to-end solutions to their clients while relying on trusted local partners to ensure global coverage.

• Digitalization: a lever for differentiation and value creation

Digital transformation has become a key pillar for freight forwarders, providing optimization tools and high-value solutions for clients. Innovations such as “Track & Trace” systems enable real-time shipment tracking, delivering full transparency across the supply chain.

The integration of AI and Big Data enhances demand forecasting and route optimization, ultimately reducing costs. These innovations support more efficient logistics flow management and better operational visibility.

In a context where clients can access shipping line rates directly, freight forwarders are under constant pressure to improve their offerings to justify their pricing and margins. They continually strive to expand their service portfolio and enhance quality by offering added-value services and increasingly customized transport solutions—such as multimodal transport, specialization in certain geographic areas or specific trade lanes, and handling of goods requiring special conditions.

Although the sector is seen as complex on a global scale, with high barriers to entry, Africa could offer promising opportunities for the freight forwarding industry

Africa represents significant growth potential for the freight forwarding sector in the coming years, for several reasons. The African Continental Free Trade Area agreement is expected to increase intra-African freight by 28% and demand for maritime freight by 62%.

According to the 2024 edition of Agility and TI Insight’s Emerging Markets Logistics Index, over 60% of logistics professionals express interest in investing in Africa. Among them, 47% are already present and planning additional investments, while 14% are considering investing for the first time. This reflects a clear interest in the African transport and logistics market.

However, this market remains complex, with specific regional characteristics. Moreover, major international players such as DHL, Kuehne+Nagel, DB Schenker, CEVA, and Bolloré are already well established across the continent, either directly or through local partners.

To fully capitalize on this promising market, freight forwarders must overcome several structural challenges and define a robust, targeted market entry strategy. This strategy should address key questions such as:

Which strategic routes should be prioritized? Which countries should be targeted for import/export? Which customer segments and categories of goods offer the most potential for growth? How can freight cost volatility be managed to maintain healthy profit margins?